"Sir_Stig: and toxic masculinity ruins the party again." (sir-stig)

"Sir_Stig: and toxic masculinity ruins the party again." (sir-stig)

05/04/2015 at 23:46 ē Filed to: Car Financing.

0

0

23

23

"Sir_Stig: and toxic masculinity ruins the party again." (sir-stig)

"Sir_Stig: and toxic masculinity ruins the party again." (sir-stig)

05/04/2015 at 23:46 ē Filed to: Car Financing. |  0 0

|  23 23 |

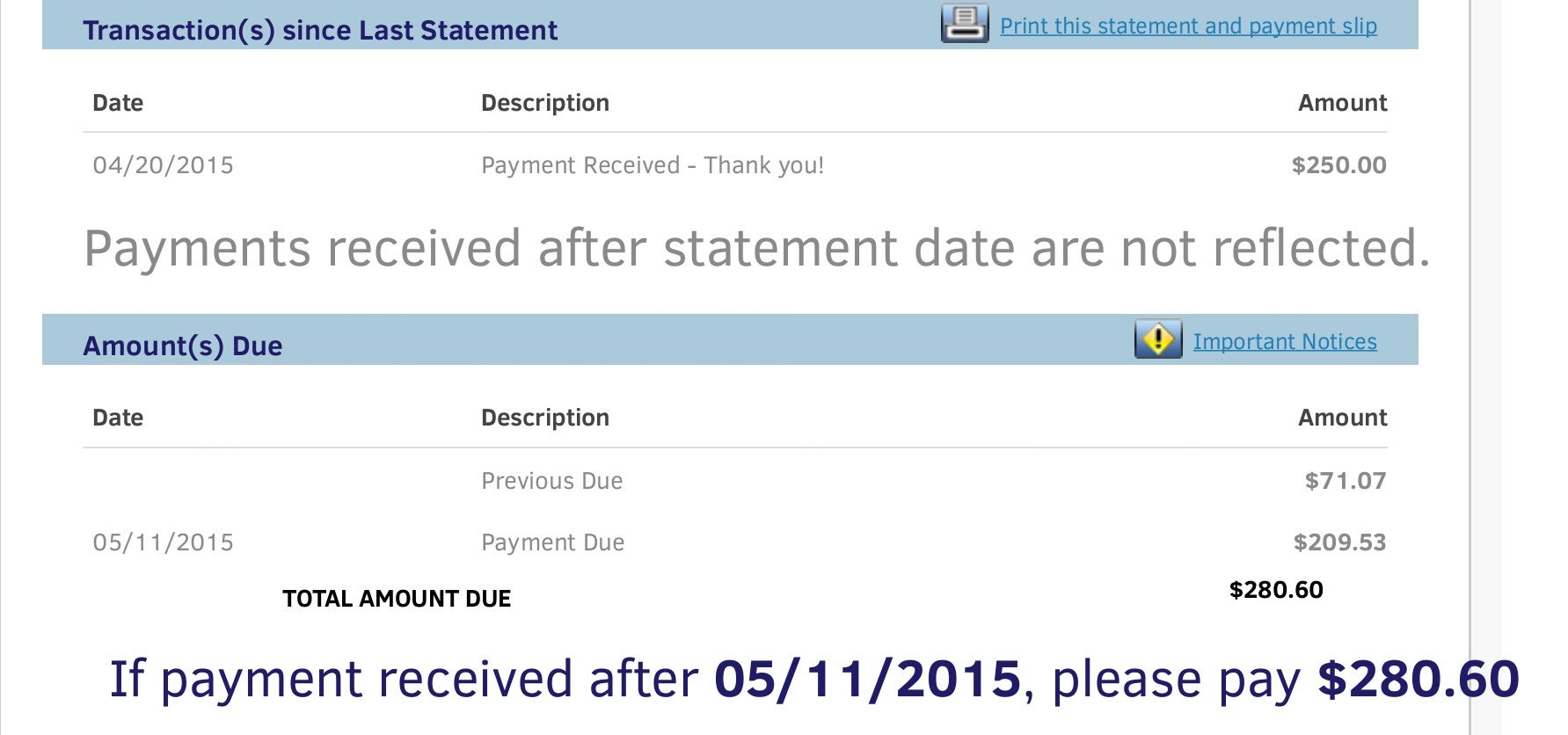

The Fiesta ST is my first financed car, and the financing is really confusing me lately. Recently itís been saying Iíve been paying my bills late, but Iíve been paying at almost the exact same time, even early and/or more than normal and itís still saying that Iím late and/or have back charged. Anyone care to explain what the heck is going on? I donít understand. I just paid 300, but it hasnít been processed yet.

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> Sir_Stig: and toxic masculinity ruins the party again.

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> Sir_Stig: and toxic masculinity ruins the party again.

05/04/2015 at 23:57 |

|

Have you contacted the bank that issued the financing?

It may be an error on their books to the late fees, they may have unknownly changed the terms to your finance agreement.

Sir_Stig: and toxic masculinity ruins the party again.

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

Sir_Stig: and toxic masculinity ruins the party again.

> Dwhite - Powered by Caffeine, Daft Punk, and Corgis

05/05/2015 at 00:06 |

|

Well itís through Ford itself, but no, I was going to phone them and see whatís up, just figured Iíd run it past oppo first.

PatBateman

> Sir_Stig: and toxic masculinity ruins the party again.

PatBateman

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 00:10 |

|

Why are you not paying one monthly payment?

PatBateman

> Sir_Stig: and toxic masculinity ruins the party again.

PatBateman

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 00:13 |

|

Also, your payments are due every two weeks (you need to change that). You're trying to pay the same time every month. Every two weeks doesn't equate to the same time every month.

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> Sir_Stig: and toxic masculinity ruins the party again.

Dwhite - Powered by Caffeine, Daft Punk, and Corgis

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 00:25 |

|

Iíd see what they have to say, it maybe a simple misunderstanding between you and Ford Credit. The data is only as good as its originally entered so there very easily have been a mistake along the way.

Luc - The Acadian Oppo

> Sir_Stig: and toxic masculinity ruins the party again.

Luc - The Acadian Oppo

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 01:05 |

|

Iím confused? In Canada it must be a different system altogether. In Canada when you finance a car you have no bill to pay where you can have a late payment and such. In canada the money is taken automatically from your bank account either once a month of every two weeks. As long as you have money in the account you will NEVER have a late payment.

Are you telling me that in the US you actually have to go into your online account and make a payment every time? That is a piss poor system if you ask me.

Here you never have to even think about it as long as you have the money in the account your all good.

Svend

> Luc - The Acadian Oppo

Svend

> Luc - The Acadian Oppo

05/05/2015 at 01:59 |

|

Same here in the U.K. Pay your down payment/up front deposit and then monthly payments come out by direct debit/standing order for the agreed amount each calendar month.

Kailand09

> Sir_Stig: and toxic masculinity ruins the party again.

Kailand09

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 06:21 |

|

Did you get a really good % rate? If not, I would look into refinancing through a bank or credit union, and if you have an account there do automatic withdrawal for another ~.25% off.

Otherwise, youíd need to call in to Ford Credit and work that out.

yamahog

> Svend

yamahog

> Svend

05/05/2015 at 06:25 |

|

But then how could someone extend you a predatory line of credit that you canít afford and then trade your debt in order to set off a multinational recession?? Talk about anti-business!

/s

yamahog

> PatBateman

yamahog

> PatBateman

05/05/2015 at 06:28 |

|

ďI can cut your payment in half!Ē

-dealer, probably

I really hope not though. And $420/mo seems a bit high for a FiST :(

jariten1781

> Luc - The Acadian Oppo

jariten1781

> Luc - The Acadian Oppo

05/05/2015 at 08:44 |

|

Itís an option with every bank/loan Iíve used since the late 90s to have auto payments. You have to opt in though, itís not automatic. Thereís a lot of folks (my parents being some) that maintain an old-school paper account register and prefer to do manual payments so they always control their cash flow.

If you have a loan without pre-payment penalties you can set the auto payment amount you want to pay and the dates as well so if you want to throw an extra 50$s a payment at the principle you can. You can also set it to pay every 4 weeks instead of monthly which will amount to one extra payment a year getting you out from under the loan a little more quickly (and less interest).

Itís a very good system, it just requires you to make some choices and be proactive at the beginning of your term.

It also requires you to have basic financial knowledge which they only teach as an elective in high schools, which is a shame for people whose parents donít prep them. Since about the mid-90s they removed Home Economics from the core curriculum in most places to elective on the complaints of high performing students who wanted to take additional science/math/whatever classes to be more competitive on college applications...which was fine for them since they mostly had involved parents, but kind of screwed over the lower performing kids whoíd elect to take some fluff like Drawing rather than learning life skills...not that thereís anything wrong with artistic endeavors, but theyíre truly elective whereas knowing how to pay your bills is kind of a necessity. Iíve heard (no first hand knowledge though) that some schools have dropped the course all together due to the low take rate and instead offer it as workshops over lunch which Iím totally sure all the kids who need it are flocking to since, you know, sitting with an old dude talking about paying loans is soooo much cooler than hanging with your friends.

Now, there certainly are shady lenders at the bottom of the loan ladder who purposefully make it obnoxious to pay back, but if youíre in a spot where you need those types of loans youíd better be watching every penny and pay as early and as much as possible to get back into the normal banking world...Ford Credit is not one, theyíre easy to use.

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 08:50 |

|

Theyíre billing every 14 days, youíre paying at some longer period (19 day gap for your two April payments, 18 days for the two March payments) so yeah, youíre late. If the guy/gal who gave you the loan implied youíd be on a twice per month cycle they were wrong, youíre on an every two week cycle. You need to catch up then either switch to every two week payments or refinance.

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

05/05/2015 at 09:09 |

|

The part I donít under stand is that Iím paying on basically the same days but now for some reason itís saying Iím late. They seem to have changed my due dates.

Sir_Stig: and toxic masculinity ruins the party again.

> Kailand09

Sir_Stig: and toxic masculinity ruins the party again.

> Kailand09

05/05/2015 at 09:09 |

|

itís 1.49%, so not that bad.

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 10:16 |

|

Nope, just looking through the chain your due dates have always been 14 days apart. Every other Monday since the first charge listed (looks like you didnít list December but those Invoice Due Dates should have been the 8th and the 22nd). Theyíre consistent.

Now, if youíve been sending in your stuff every other Thursday or something it could be that there have been mail or processing delays. If youíve been paying around the 1st and 15th (which is kind of what it looks like) youíre going to fall behind because a month has 30.4 days on average and theyíre expecting payment on a 28 day (14 x 2) schedule. You essentially lose a couple days per month paying that way.

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

05/05/2015 at 10:34 |

|

Ah I think Iím understanding. Iíll double check with them today, as I was under the assumption it was bi-weekly anchored on the start of the month like how my car insurance payments work. I suppose I could just do the 14 day thing, but it is more convenient to just pay more per payment twice a month. Iíll have to think about it.

EDIT: so if I just paid $300 (it went through yesterday) I will be fully caught up, right? and then I can set up payments ever two weeks starting on the 11th of may and I should be good? Or is the next payment the 25th?

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

jariten1781

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 10:46 |

|

Yeah, what you are comfortable with (1st and 15th) is a semi-monthly plan, and what you have is a bi-weekly plan. For overall financial health you actually want the every 2 week (bi-weekly) plan if you can swing it. It turns out to be an extra couple payments per year which pays off the loan faster leading to less interest outlay. Same thing when you get a mortgage you want an every 4 week plan as opposed to once a month if you can swing it, pays big dividends there since the term is so long. You can refinance to make a semi-monthly payment have the same term as a bi-weekly payment, but thereís usually refinance charges and differing interest rates that make it not worth it.

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

Sir_Stig: and toxic masculinity ruins the party again.

> jariten1781

05/05/2015 at 10:51 |

|

Ah okay, I was confused because both my mortgage and my insurance are both semi-monthly and I conflated them to be the same as bi-weekly. Once I saw the literal 14 day schedule it started to make sense. Hmm I guess Iíll set up the schedule and just set it to be $210, should work out to be about the same as 300 semi monthly as far as money between paychecks is concerned.

Luc - The Acadian Oppo

> jariten1781

Luc - The Acadian Oppo

> jariten1781

05/05/2015 at 10:56 |

|

But the way I have it setup is I get deducted bi-weekly, 2 extra payments a year over semi monthly. so the day I get paid a payment goes out automatically. If I want to pay extra just go into my online bank account and make a transfer to the loan for $50,$100,$500 ect.

The car gets paid exactly the same except you donít have to manage the payments AT ALL. So if you are on holiday in the middle of nowhere you donít need to try to find wifi so you can pay your car bill.

Everything is the exact same except no need to micro manage anything. I would go nuts if I had to actually sit down and manage all the bills especially when there is absolutely no need to do so.

Oh and in Canada you donít have the option to pay it your guys way. You either pay it in full upfront or it gets debited from your account.

NOW I see why the repossession thing is so big in the States. Itís so easy to buy a car and not pay for it.

BKosher84

> jariten1781

BKosher84

> jariten1781

05/05/2015 at 10:56 |

|

For overall financial health you actually want the every 2 week (bi-weekly) plan if you can swing it. It turns out to be an extra couple payments per year which pays off the loan faster leading to less interest outlay.

This is how I pay my Mortgage/Student Loans. I am essentially making 2-3 extra payments in a time span of a year because of this.. Cutting my total mortgage/student loan repayment plan down dramatically.

Sir_Stig: and toxic masculinity ruins the party again.

> yamahog

Sir_Stig: and toxic masculinity ruins the party again.

> yamahog

05/05/2015 at 10:56 |

|

Well Iím paying it off on a 36 month (60 payment) term, so the payments are comparatively high compared to doing a 60 month term. I wasnít really concerned about payment size, I just wanted to save a bit of interest. Also, welcome to Canada, where trucks are dirt cheap, and small cars come at a premium.

jariten1781

> Luc - The Acadian Oppo

jariten1781

> Luc - The Acadian Oppo

05/05/2015 at 11:04 |

|

You donít have to micromanage it. You just set it up when the first bill comes in. I have mine all set up exactly like yours and never think about it. The only difference seems to be that here it defaults to manual pay and there it defaults to auto pay but in both you have the option to switch it to your liking.

Kailand09

> Sir_Stig: and toxic masculinity ruins the party again.

Kailand09

> Sir_Stig: and toxic masculinity ruins the party again.

05/05/2015 at 17:19 |

|

Oh then my point is moot. lol